By Jin Lu

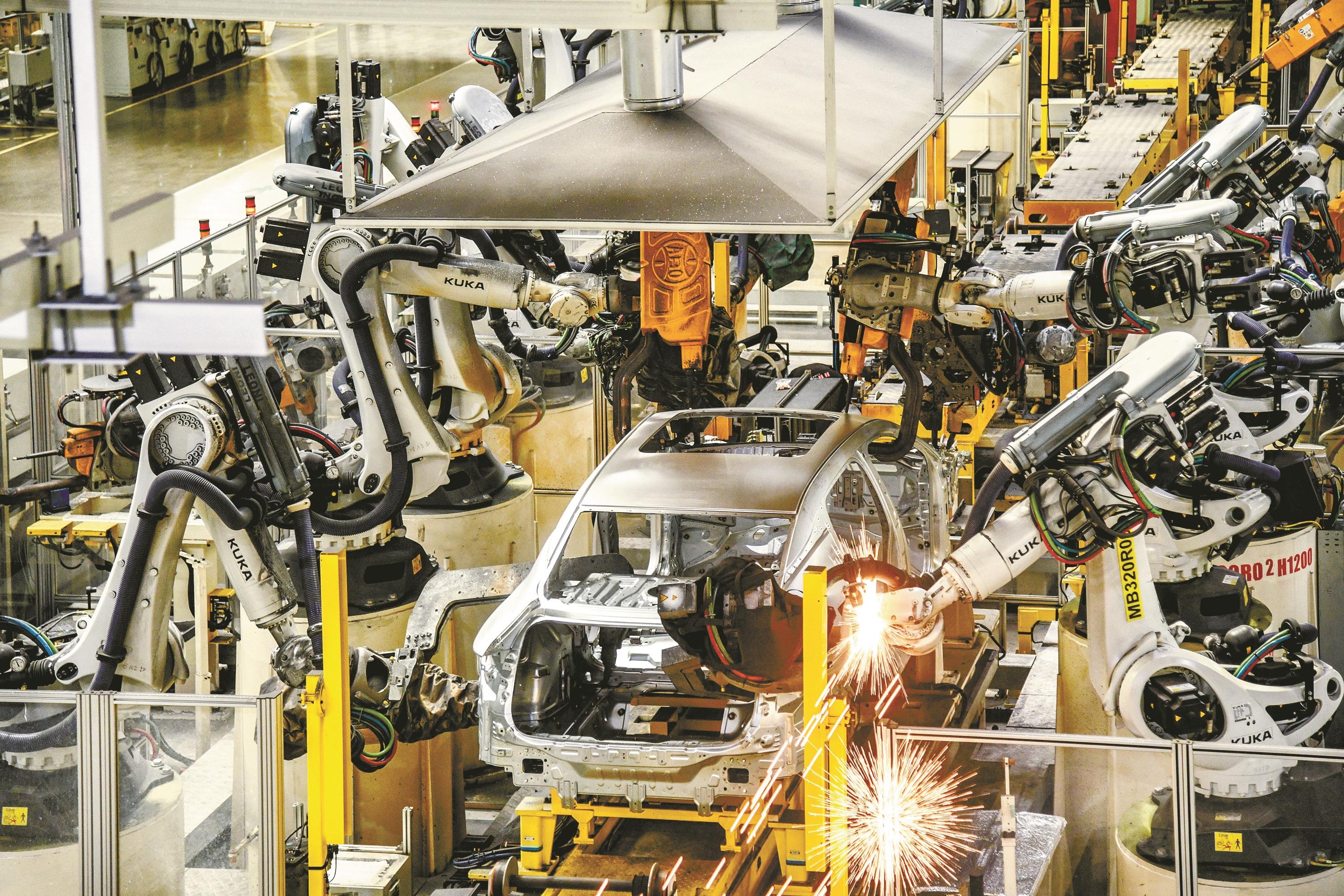

In the first half of the year, despite an intensifying price war and heightened internal competition in the automotive market, Geely Automobile Holdings Limited delivered an outstanding mid-year financial report. The company's revenue reached RMB 107.3 billion, a remarkable 46.6% year-on-year increase. Net profit attributable to shareholders, excluding non-recurring items, surged by 114% to RMB 3.37 billion. Additionally, net cash levels grew by 25.4%, hitting a record RMB 35.7 billion.

Geely's ability to surpass RMB 100 billion in revenue is a testament to its rapid adjustments and steady progress. But what key factors contributed to this success?

Strengthened Multi-Brand Performance

A car manufacturer's enduring success hinges on its product capabilities. According to the mid-year report, Geely's focus on enhancing profitability across its multiple brands and balancing new energy vehicles (NEVs) with traditional fuel vehicles has paid off.

Geely's total sales in the first half of the year reached 956,000 units, a year-on-year increase of 41%. NEV sales, spanning Geely, Lynk & Co, and Zeekr, rose to 320,000 units, marking a 117% increase. NEV penetration climbed from 21.8% in the same period last year to 33.5%, with three consecutive months of year-on-year and month-on-month growth, placing Geely among the top NEV brands.

Breaking it down by brand, Geely Galaxy, the company's mid-to-high-end NEV series, achieved sales of 81,000 units—a stunning 742% year-on-year increase. Monthly sales consistently exceeded 10,000 units. Lynk & Co sold 126,000 units in the first half of the year, a 53.6% year-on-year increase, with cumulative sales surpassing 1.17 million units by June 2024. Notably, NEV sales accounted for 50.9%, setting a new record for the brand.

Zeekr also showed impressive growth in this current reporting period, delivering 87,870 vehicles in the first half, a 106% year-on-year increase. In June alone, Zeekr delivered 20,106 vehicles, breaking the 20,000 monthly delivery mark for the first time.

These brands, coupled with economies of scale and an optimized product structure, have significantly boosted Geely's profitability. Gross profit soared to RMB 16.2 billion, with a gross margin of 15.1%. The group also made notable progress in cost control, with sales and administrative expenses both decreasing year-on-year.

Geely's management reiterated their strategy in multiple briefings on the Group's performances, "We do not engage in price wars, only value wars." According to them, competition is about delivering high-value products, leveraging their technical strengths and cost control capabilities. Geely remains committed to winning "value wars" over "price wars."

To maintain competitiveness, Geely has significantly increased R&D investment, which is its answer to the challenge. In the first half of the year, R&D spending rose by 17.9% year-on-year to RMB 7 billion, ensuring Geely stays at the forefront of electric motor, battery, and smart technology innovations. Additionally, Geely is making forward-looking plans in artificial intelligence, the trends of the era.

Accelerated Global Expansion

Geely Auto's international business has garnered significant attention from investors. The financial report highlights Geely's strong export performance, with cumulative export sales in the first half of the year reaching 197,000 units—a year-on-year increase of over 67%, outpacing the market. In response, Geely has raised its annual overseas export target from 330,000 to 380,000 units.

By brand, Geely expanded its presence in regions including the Middle East, Asia-Pacific, Africa, Latin America, and Europe. In the first half of the year, Geely launched 12 new products across 30 overseas markets. Since Lynk & Co's European strategy began in 2021, the brand has shipped over 72,000 units globally. Meanwhile, Zeekr has accelerated its internationalization, entering markets such as Sweden, the Netherlands, the UAE, Saudi Arabia, and Mexico, with its Zeekr 001 and Zeekr X models now being delivered abroad.

Geely also continues to build strategic partnerships through investments and shareholding arrangements. For instance, Geely holds a 34.02% stake in Renault Korea, which achieved sales of 42,000 units and a net profit of RMB 85 million in the first half of the year. Renault Korea provides steady returns, with Geely receiving dividends of RMB 180 million in 2023 and RMB 150 million in the first half of 2024.

Additionally, Geely's 49.9% stake in Proton contributed to sales of 78,000 units and a net profit of RMB 126 million in the first half of the year.

A Glimpse Into the Future

Geely's highlights of its mid-year performance—crossing the RMB 100 billion revenue mark, exceeding RMB 10 billion in profits, and seeing a fivefold surge in net profit—demonstrate its ability to thrive in a fiercely competitive market.

Looking ahead, Geely is poised for further growth, supported by new model launches across multiple brands, cutting-edge technology, and a strong push towards globalization. These accomplishments represent just the beginning of what is shaping up to be a bright future for the company.